Market Rally Broadens – New All-Time Highs?

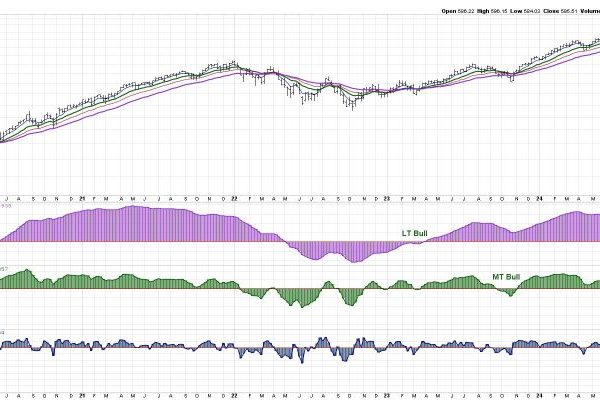

Today Carl looks at the small-caps and mid-caps that have now begun to outperform the market. Clearly the rally is broadening, the question now is can we continue to make new all-time highs. It does seem very likely especially given the positive outlook on the Secretary of Treasury nomination. Carl reviews the signal tables and…