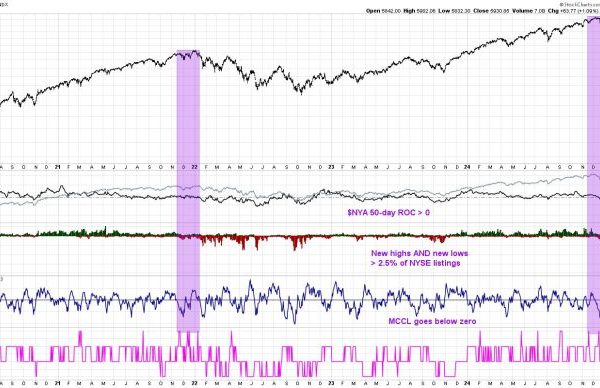

2024’s Big Bang: A Deeper Dive Into the Hindenburg Omen

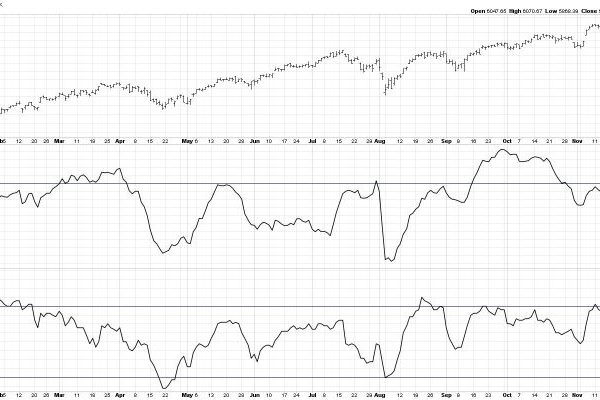

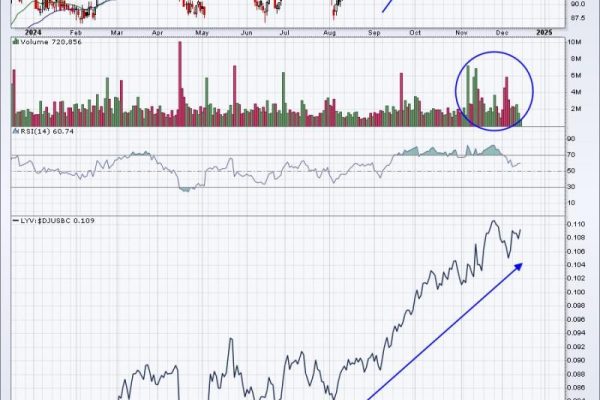

This week saw the fabled Hindenburg Omen generate its first major sell signal in three years, suggesting the endless bull market of 2024 may soon indeed be ending. Why is this indicator so widely followed, and what does this confirmed signal tell us about market conditions going into Q1? First, let’s break down the conditions that led…